Background: Halt and Catch Fire (HCF)

In AMC Network’s new retro TV series “Halt and Catch Fire” we meet the anti-hero protagonist, Joe McMillan, who is struggling to design and launch a new PC during the dawn of the PC revolution in the early ‘80’s. Their little company “Cardiff Electric” has no business in the PC market. They are a Texas software company with no experience designing or building hardware, and no credibility in the market. Joe has positioned them to go head to head with the IBM PC the recognized market leader.

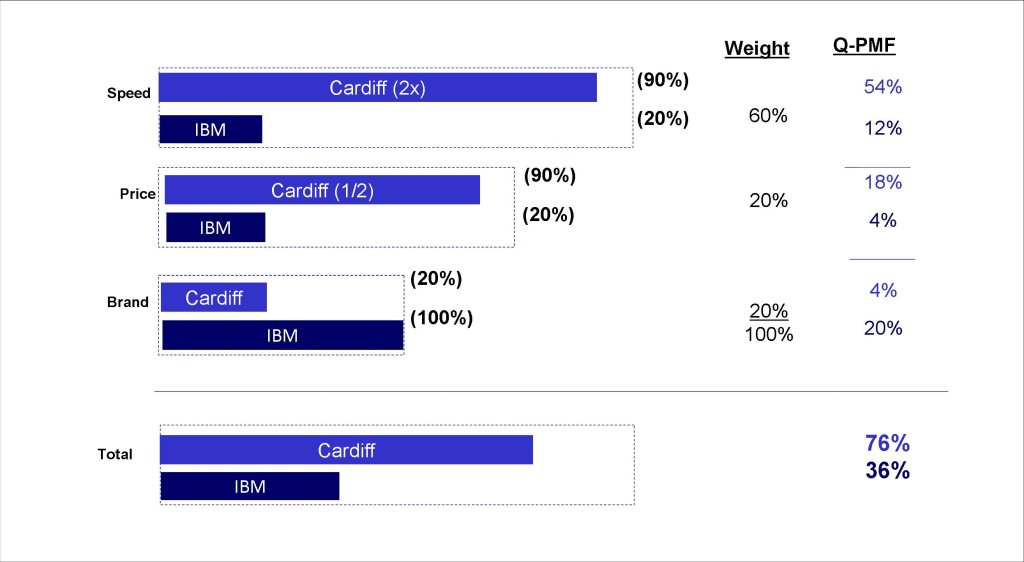

In our previous post “Halt and Catch Fire” we examined a future scenario where Cardiff Electronics successfully launched a PC two times faster at half the price compared to the IBM PC; we expected it to be highly appealing to both power users for speed and ordinary users for cost, and estimate that it would quickly dominate the PC market outselling the IBM PC/AT two-to-one – at least for a while.

What would happen next?

Using the Q-PMF framework, we can explore various possible future scenarios to get a better sense of the landscape of potential risks and rewards. We call this process “Future Mapping.” In this process we never assume a static “state of play;” that is if one variable changes we expect that other variables will also change to reflect either a competitive response or a change in market preferences.

Since both technology and market preferences are constantly changing, each product’s Product Market Fit is also in constant flux, and therefore must be managed dynamically by trying to stay two or three moves ahead of new technology, new competition, and evolving market preferences.

Let’s look at a possible future scenario for the fictional company Cardiff Electronics, to get a better idea of exactly what they are up against.

(Please note that for the purpose of this discussion we will speculate about future (fictional) customer satisfaction levels. In reality companies would be conducting extensive market research to understand current and future customer preferences and sentiment to inform this analysis.)

At the time in which the HCF story is set (1983), Moore’s Law was still in its infancy, and so perhaps it has been correctly left out of the plot line so far. Moore’s Law states that processing power should roughly double every 24 months at the same cost.

This means that even if Cardiff did create the technical breakthroughs necessary to make the Cardiff PC twice as fast as the IBM PC, it would only give them about a 2 year window of market leadership before Moore’s Law would allow IBM to match Cardiff’s speed as soon as the next generation of processors was available.

In fact what actually happened was worse than that due to some remarkable leaps in computer speed and performance in the first half of the 1980’s.

The HCF story is set in 1983 when Cardiff is designing a PC to compete with IBM. In March of 1983 IBM introduced the IBM “XT” based on the Intel “8088” CPU which was able to process about 1 Million Instructions per Second (MIPS). Although not made explicit in the HCF story line, this is the machine that viewers assume that Cardiff is using as a benchmark to make their machine “twice as fast at half the price.” But is it the right target?

The previous year Intel had already launched their next generation processor that could more than double the processing speed of the XT. The “80286” (a 16-bit microprocessor with a top clock speed of 12 MHz) was able to execute 2.66 MIPS.

In August 1984, IBM launched the “AT” (“Advanced Technology”) PC based on the Intel 80286 processor.

As hockey great Wayne Gretzky famously advised “skate to where to puck is going.” In order for Cardiff to have more than just a few months of market leadership, our fictional hero Joe should be targeting the next IBM machine, the IBM PC-AT at 2.66 MIPS. This means that to reach Joe’s goal, the Cardiff PC needs to reach 5.3 MIPS to be twice as fast as the IBM AT.

Even then the window for market leadership would still be short. Just 14 months later in October of 1985, Intel would introduce its next generation “80386” CPU that executed 11.4 MIPS (4.3 times faster than the 80286). In a span of only 31 months computers had become 11 x faster than the XT. Joe doesn’t realize it yet, but in order for Cardiff to survive they will have to find a way to exceed this blistering pace of technology advancement.

Using Intel’s 11 MIP 80386 CPU, IBM would have been able to not only match, but to double Cardiff’s 5.3 MIPS at no extra cost. In fact the 80386 sold for $60 less than its predecessor (a 17% price discount).

These advances in CPU Speed would have had the potential to significantly reduce or eliminate Cardiff’s Delta-V advantage in Speed.

But again we never assume a static state of play; so for the sake of discussion let’s speculate that Cardiff created more ways to increase speed than just over-clocking the CPU (e.g. faster BIOS, etc.) which they could then also use in their next 80386 based machine.

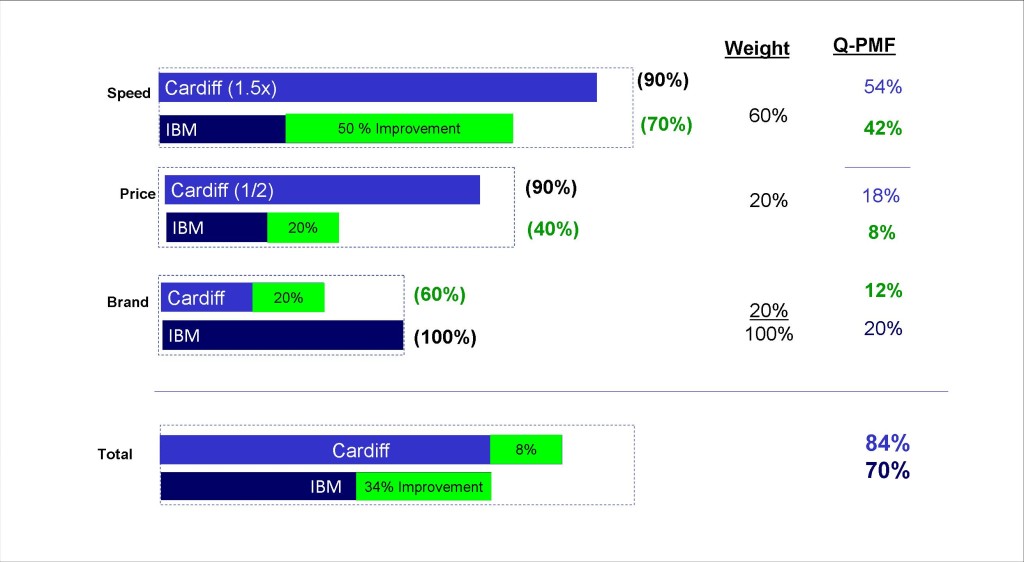

For this example let’s say that Cardiff is able to maintain a 50% speed advantage over IBM after they both upgrade to the ‘386 CPU. How would it affect their relative strategic positions and projected market shares as driven by Product Market Fit?

Here is the initial state of play we projected after Cardiff introduced their first PC which was 2x faster than the current IBM PC. We expect Cardiff to command two thirds (66%) of IBM’s PC market (ignoring other players).

But when IBM launches its next generation ‘386 machine, it would significantly close the speed performance gap and thus greatly reduce Cardiff’s Delta-V advantage in Speed.

The noticeable performance improvement (4x) of the IBM PC would greatly improve customer’s perception of satisfaction in the Speed dimension, even though the Cardiff machine is still technically faster. Let’s assume that customer satisfaction with IBM in Speed would rise from 20% to 70% (green bar).

Since the performance gap is now less, it is likely that the Price satisfaction gap will also be less. Let’s assume that IBM Price satisfaction rises from 20% to 40%.

IBM could make dramatic gains in the two major value dimensions (Speed, Price), just by upgrading to Intel’s ‘386 processor – IBM would be rapidly reducing Cardiff’s Delta-V advantage and closing the PMF gap.

But now with one successful PC under their belt, Cardiff’s performance in the Brand dimension would increase. They would be becoming a recognized and trusted brand, and thus be able to attract more customer segments beyond just the Early Adopters.

The net result of this scenario analysis is that IBM would likely be able to reduce Cardiff’s Delta-V advantage from 40% down to 14%, and thus reduce Cardiff’s market share dominance from 66% down to 54%.

Under these scenarios, Cardiff’s fist PC would capture significant market share, but within two and a half years we would expect to see IBM and Cardiff offering more or less comparable machines with equal market shares.

In the first three episodes of the series Cardiff has already been through significant trials, with more yet to come; so within the context of a fictional drama, one has to ask: Is it worth it?

In 1984 IBM had $4 billion in annual PC revenue[1], more than the next four PC companies combined (including Apple). If Cardiff were to capture half of IBM’s market share, at half the price, they would create $1 Billion in revenue. Even if they only had 10% margin, that would mean $100 million in earnings.

But in the TV series, and in real life, we know that a market leader like IBM is not going to idly sit by and watch an upstart capture half their market share if they can help it. There are many other ways that they can compete so Joe had better have a few more tricks up his sleeve if Cardiff is going to survive. According to the trailers for the next episode, he does.

[1] Libes, Sol (September 1985). “The Top Ten”. BYTE. p. 418.