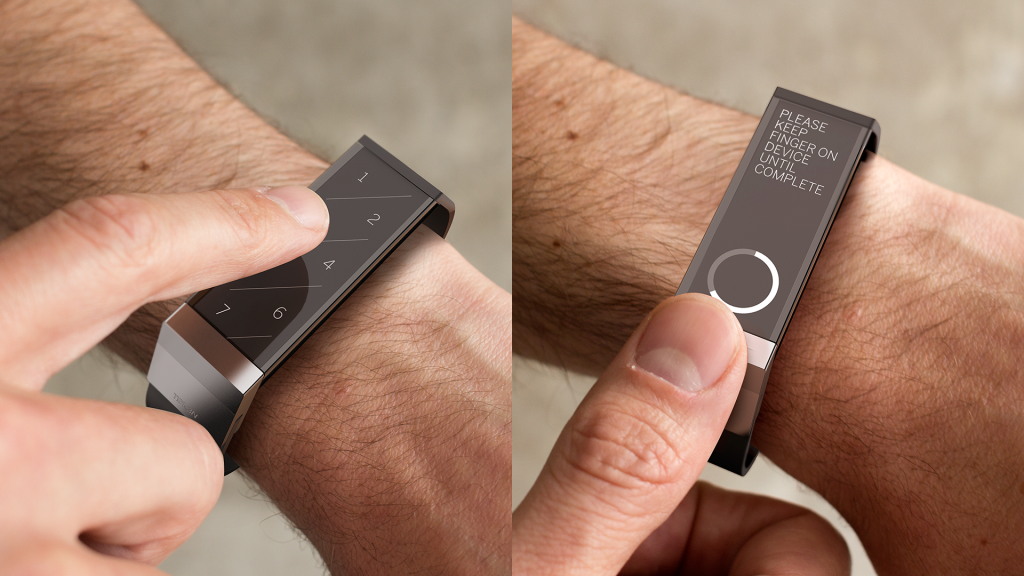

Artifact Group has recently developed a wrist mounted digital wallet prototype called Token

Token connects to the user’s various accounts including checking, savings, credit, debit cards, and PayPal, according to a recent article in Wired Magazine.

Token has four basic functions: “Pay,” to make purchases; “Give,” to transfer funds to someone else; “Ask,” to request funds from another user and “Peek,” to check bank statements.

Since the rest of the supporting technology ecosystem is not (yet) in place (i.e. compatible merchant point of sale devices, et al), Token is clearly a showcase project to demonstrate the impressive ingenuity and design skill of Artifact Group. As a masterful example of design and technology artisanship, it achieves this objective brilliantly.

However, if Token was intended to be an actual commercially launched product, we would be concerned that it falls into the category that many technology based products do which could be called “Ars gratia artis” (art for art’s sake).

Craig Erickson, a design director at Artefact says: “The big question is: What if we converged sensors and wearables to create a more efficient way of managing money?”

We respectfully disagree with Mr. Erickson’s assertion that “the big question” (essentially) is “What if we built a device that makes it easier to manage money?”

Rather we would propose that the big questions are: “Who would care if you built it?” and “How much would they care?”

Let’s take a peek at the Token concept through the lens of the Q-PMF Framework and try to reverse engineer what they are thinking to get a sense of whether Token would be a successful product if it was actually launched.

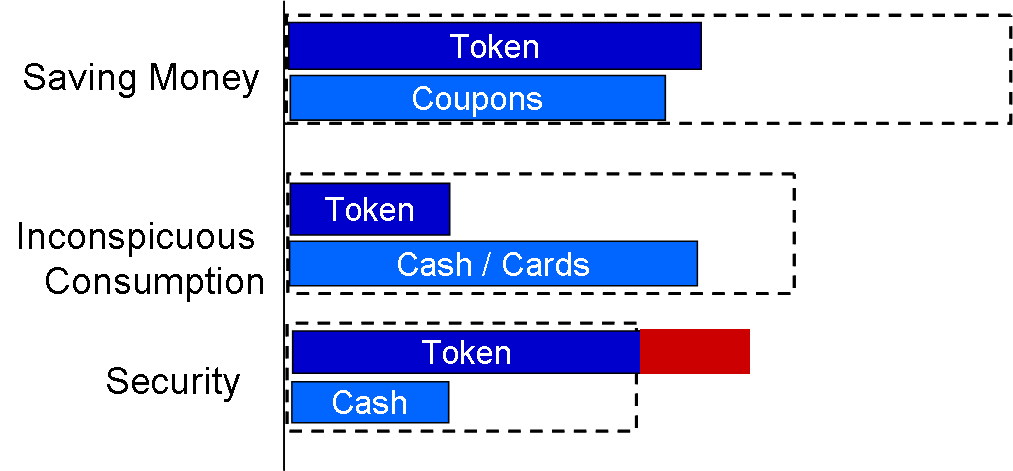

On the Artefact Group website we find the following “pain points” that they considered during the product design process (we added the implied value dimensions):

Have you ever lost your wallet and worried about whether someone went to town with your ID, money and bank information? (Security) How often do you get a replacement credit card, because the security of one of the merchants you shopped “may have been compromised”? (Security) Don’t you wish the voice of reason took over when a new bike or a pair of shoes beckoned you from the store window? (“Voice of Reason”) And how about the weekly “Mom, can I have some cash?” that turns your sulky teenager back into a pleasant person, only to disappoint her with a cashless wallet? (“Allowance Convenience”)

That is what one of Artefact designers was pondering when he imagined Token, a next generation payment device that helps you be a smarter consumer.

From this description we can make an educated guess about how the Token designers were thinking about their Customer Value Model.

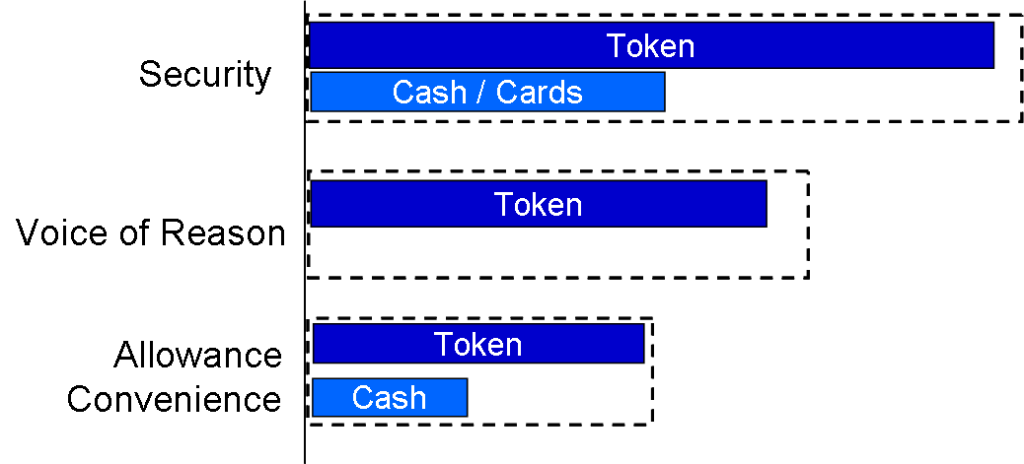

They believe that Security is the most important value dimension for consumers, followed by a new value innovation we’ll call the “Voice of Reason” followed by the a desire to make it more convenient to give digital money to teenagers (“Allowance Convenience”).

The Q-PMF chart for Token might look something like this:

Token clearly outperforms cash and cards along each of these dimensions. Note that we have presumed that cash and cards have no performance at all along the new “Voice of Reason” value dimension, giving Token a significant Delta-V advantage in both that important dimension and overall.

Token clearly outperforms cash and cards along each of these dimensions. Note that we have presumed that cash and cards have no performance at all along the new “Voice of Reason” value dimension, giving Token a significant Delta-V advantage in both that important dimension and overall.

Assuming that the designers have accurately identified the Customer Value Model for their target market segment, Token would have both high Product Market Fit (i.e. a high Q-PMF score) and would have a high Delta-V over other options. Based on these advantages over both cash and cards we would expect Token to be an “out of the park” Home Run.

But is this Customer Value Model an accurate representation of the real world? This is where many new product designs start to have problems. In fact a study by the Product Development Institute suggests that nearly half of new products fail – many of which may be due to poor Product Market Fit.

Let’s consider an alternate approach.

Many payment innovations approach the “problem” primarily from the merchant’s perspective which is how to make it faster, easier, and less mentally painful for the consumer to spend more money.

But are we certain that consumers themselves think that their current payment options are painfully slow, worrisomely insecure, or just inconvenient? Like most markets there is probably a range of customer opinions which creates a range of value based customer segments.

If the consumers who think that payments would benefit from at least some improvement have a different Customer Value Model that either places different importance weights on the value dimensions, or includes different value dimensions, then the overall Product Market Fit could be significantly different.

For example what if the way that most consumers thought that payments could be improved most was not by making it easier to pay, but instead making it easier to save money? The way that Token and many other coupons schemes address “Saving Money” is by alerting users to promotional discounts. But most promotional discounts are actually intended to be an inducement to spend more money based on the classic marketing hucksterism of “the more you spend the more you save.”

While features that increase the “Voice of Reason” dimension may help to curb frivolous spending, it may not actually help to save money on necessary spending. In this scenario, consumers most interested in saving money may feel that Token is about as effective as other digital coupon schemes which only have moderate performance in reducing their total spend.

Another challenge for Token may come from not considering the psychological or social dimensions associated with payments and money in general. While some people value conspicuous consumption (e.g. “bling”), many others prefer inconspicuous consumption. For this segment wearing a payment device on one’s wrist would be less attractive than keeping cash and cards out of site in one’s pocket.

Alternatively, if Token is intended to replace a traditional watch (assuming it has a clock function), how will it be perceived by the segment of expensive watch owners (especially men) who value “Prestige?” Regardless of its cost, will the Token be seen like a Rolex or a calculator watch?

Finally, while security is clearly important, consider the scenario where the designers have overestimated its overall importance. If Token is so secure that it is difficult to use, it could over-perform in the Security dimension which could be a liability (shown in red).

This exercise shows the importance of getting the Customer Value Model right the first time. If Token’s designer’s assumptions about consumer preferences are reasonably accurate they could have the next big hit; but if the Customer Value Model is different than they expect – they could have an expensive flop.

Unfortunately physical products like Token do not readily lend themselves to a “lean startup” approach, starting with an MVP (Minimum Viable Product) and then iterating based on market feedback. The investment required to build the first batch of products that doesn’t sell well, in addition to the costs of making software or hardware changes to the next generation could be prohibitively expensive.

Conducting detailed market research of customer’s preferences during the design process is often one of the best investments innovators can make, which is why we call it “cheap insurance.”

We wish the Artifact Group great success with the Token and look forward to trying one ourselves soon!